Account for your Leases with Confidence

Complying with FASB & IASB standards is a headache in Excel. LeaseGuru makes it simple and secure to account for small lease portfolios under ASC 842 or IFRS 16.

All the Compliance Necessities

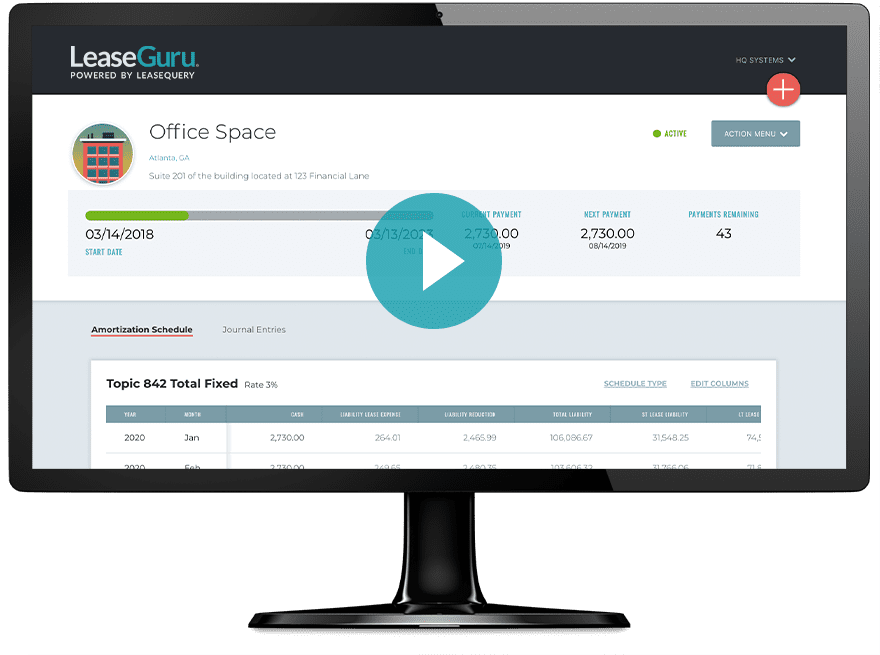

| Detailed Amortization Schedules Insight into your lease expenses without spending hours in Excel. Just enter your payment information and LeaseGuru does the work! |

|

| Ledger Agnostic Journal Entries Journal entries with the click of a button – regardless of which general ledger you use. |

|

| CPA Approved Calculations Brought to you by LeaseQuery, the solution trusted by 3000+ organizations, LeaseGuru helps you comply with confidence. |

LeaseGuru Plan Types

Single Company

Multi-Company

Ideal for accounting firms looking to provide lease accounting as a service for up to 5 clients (10 leases each).

LeaseGuru Pricing

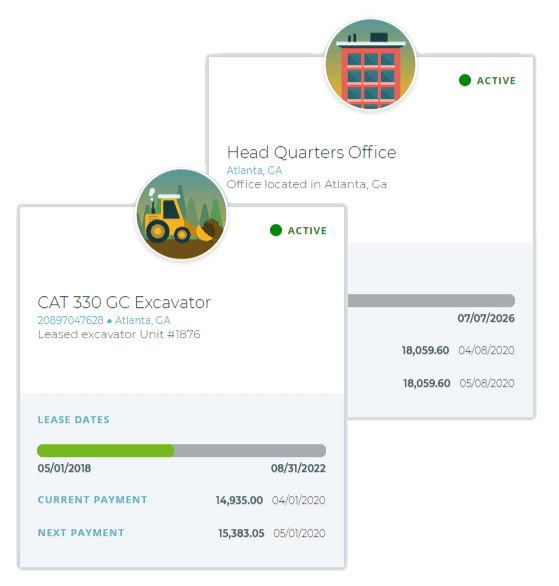

Single company plans are best for those accounting for their own leases (1-15 leases).

Multi-company plans are best for firms doing lease accounting for up to 5 clients with up to 10 leases each.

Request

pricing

Frequently Asked Questions

How do I get started?

LeaseGuru is a self-service lease accounting software which means you can get started on your own. Create your free account, and add your leases to start.

How will I know that my leases will be fully ASC 842 or IFRS 16 compliant?

Our software has been thoroughly tested and approved by accountants for financial accuracy and compliance.

Is LeaseGuru really free?

Yes! LeaseGuru is completely free for up to 2 leases.

How many leases am I able to account for with LeaseGuru?

For single companies using LeaseGuru, you can account for up to 15 leases under IFRS 16 or ASC 842. For multi-client plans, you can account for up to 5 clients with up to 10 leases each. If you need to account for more leases, you can request pricing for our larger solutions – LeaseQuery Essential or LeaseQuery Advanced.

What if I have more than 15 leases?

LeaseGuru is designed to account for small lease portfolios of 15 or less. If you need to account for more leases, you can request pricing for our larger solutions – LeaseQuery Essential or LeaseQuery Advanced.

Does LeaseGuru offer support?

No, LeaseGuru is self-service, lease accounting software designed for you to complete your lease accounting on your own. For questions, please reference the Knowledge Base that contains answers to common topics. For software issues, please contact info@leaseguru.com. For billing questions, please email payments@leaseguru.com

What payment options does LeaseGuru accept?

LeaseGuru only accepts payment via credit card (Visa, MasterCard, Discover and American Express). Checks are not accepted at this time. For billing questions, please email payments@leaseguru.com

What kind of reports are available?

LeaseGuru provides amortization schedules, journal entries, and quantitative disclosures for your lease portfolio under ASC 842 or IFRS 16.

Can I export amortization schedules in LeaseGuru?

Yes, if you upgrade to LeaseGuru Premium you are able to export amortization schedules and journal entries.

Will I be able to make mid-lease changes, terminations or renewals?

Yes, you will have the ability to amend your entered lease to make modifications, early terminations, and extend your lease term.